November 30, 2023

Understanding Liquid Staking Tokens: Rebasing vs. Capital Gains

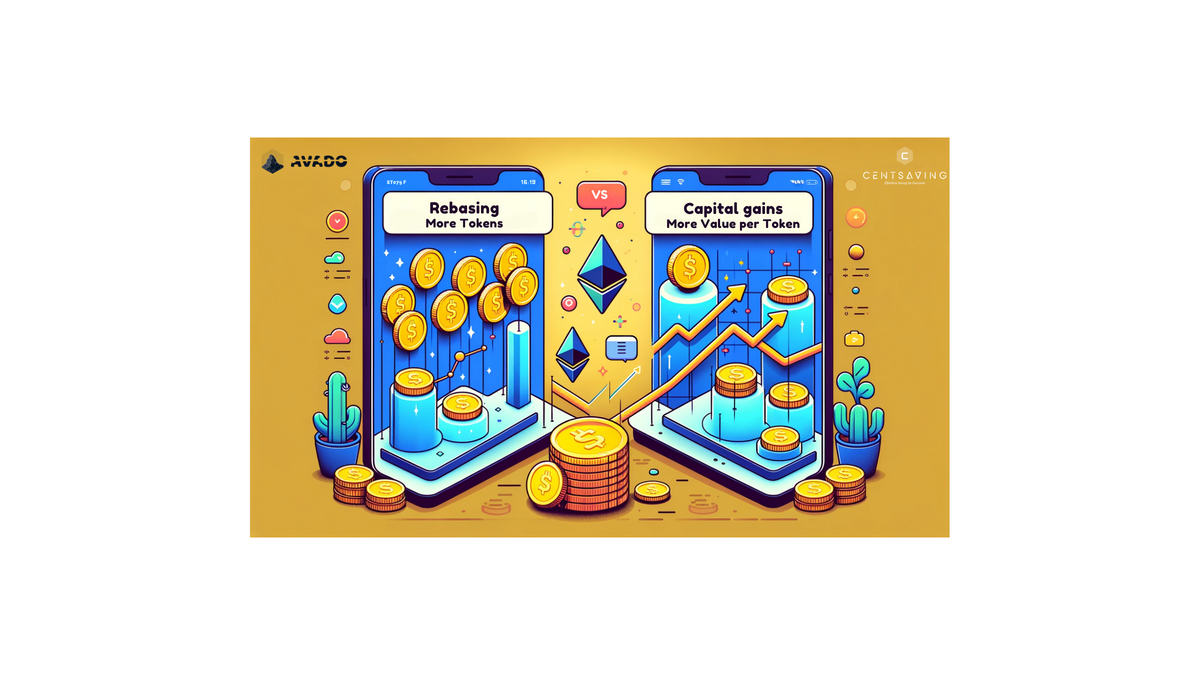

Liquid staking tokens offer a unique approach to earning rewards in the crypto world. Let’s explore the differences between two fundamental concepts: rebasing and capital gains, through the experiences of Alice and Bob.

Alice’s Rebasing Token

Alice holds a token that undergoes rebasing. Rebasing adjusts the token’s supply periodically. If the token’s value drops below a target price, the supply decreases; if it’s above, the supply increases. This is akin to a dividend or income, as Alice finds her token quantity changing frequently.

Tax Implications for Alice

From a tax perspective, Alice’s rebased tokens could be considered income. This means that any increase in her token quantity might be taxed as ordinary income, depending on her jurisdiction’s tax laws.

Bob’s Capital Gains Token

Bob, on the other hand, owns a token that appreciates in value but doesn’t rebase. His profits are realized as capital gains when he sells the tokens at a higher price than he bought them.

Tax Implications for Bob

For Bob, any profit made from selling his tokens at a higher price than the purchase price is subject to capital gains tax. This tax is typically lower than the tax on ordinary income and is realized only upon sale, offering potential tax planning advantages.

Conclusion

Liquid staking tokens and their tax implications can vary significantly. Understanding whether your token rebases or accrues value can help in making informed investment decisions and planning for potential tax obligations. Always consult a tax professional to understand the specific implications for your situation.