February 15, 2023

Stake Of Blockchain Report

As a leader in the home-staking industry, we have compared the biggest PoS blockchains to determine what’s next for the staking world and what we can expect from the most popular staking asset which is ETH when withdrawals are enabled in march.

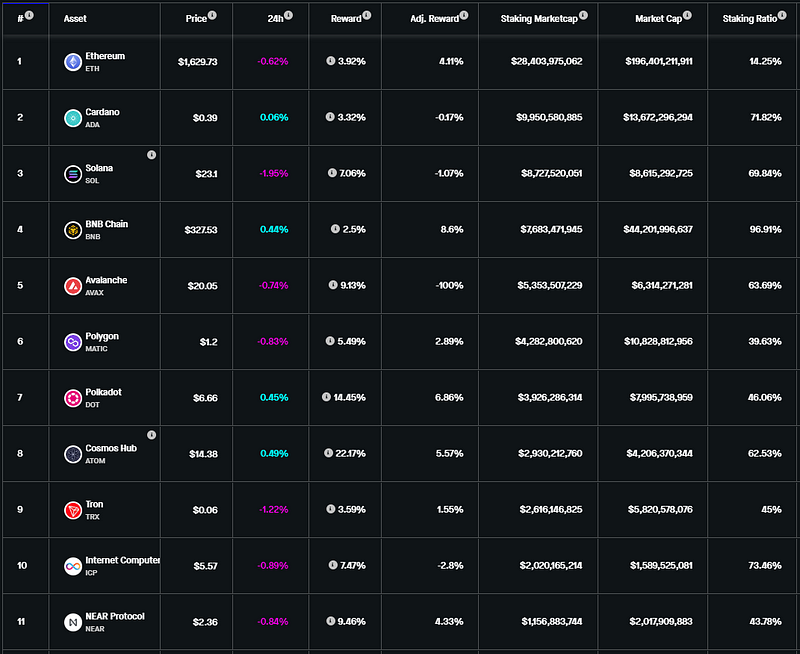

If we take a look at staked supply in relation to the overall market cap we can immediately see an interesting deviation when it comes to Ethereum compared to other PoS chains. It appears that the Ethereum staking ratio is the smallest despite being the most popular staking asset and the 2nd biggest blockchain overall. While all other PoS chains are well above a 50% staking ratio, Ethereum does only have 14,25% of its total supply staked. But yet Ethereum handles more transactions than half of its competitors.

So what is the reason why these other PoS chains have such high staking ratios?

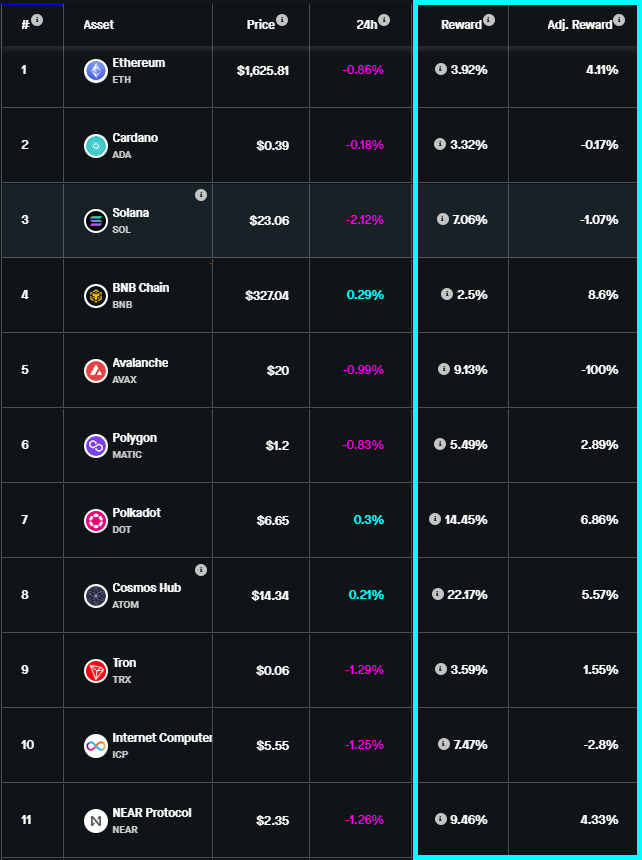

Staking rewards first come to mind and looking at the yearly returns you could make that argument for most chains, but if you look at the adjusted yearly return which takes network inflation into account you see that Ethereum actually ranks 5th out of the 11 biggest PoS chains.

Ethereum since its switch to PoS has become deflationary and is the first chain to do so resulting in higher rewards than the APY (yearly return) suggests.

All of these observations indicate that the reason for this anomaly of high staking ratios with eth competitors can be attributed to the fact that stakers are able to withdraw their stake.

While some argue that withdrawals will trigger a mass dumping of Eth we see a lot of indicators that suggest that the opposite might be the case.

A mass exit seems unlikely with 59% of stakers at a loss.

The other big factor is the staking ratio compared to its direct competitors, it strongly suggests that there are a lot of eth holders sitting on the sidelines and waiting for withdrawals to be enabled before entering the eth staking space. JP Morgan analysts expect the ratio of staked Ether to move towards the 60% average on other Proof-of-Stake blockchains.

It also allows DAOs to chime in and stake their treasuries for additional yield.

We believe that there is a strong bull case for Ethereum that can be made with the shanghai upgrade coming up. But remember, this is not financial advice. DYOR.