July 20, 2021

Ethereum 2.0 Staking, Earn Rewards: Best Options Compared

Ethereum 2.0 Staking, Earn Rewards: Best Options Compared

May 13 · 6 min read

Ethereum, the second most valuable cryptocurrency by marketcap after Bitcoin, has taken off in popularity and price lately.

With this recent boom, many investors wonder how they can take advantage of Ethereum’s rise by earning interest on their investment.

This blog post will compare some of the best options available for staking Ethereum and earning rewards.

What is Ethereum Staking?

Staking is the process in which users of a blockchain put crypto-assets at stake (hence the term ‘staking’) to perform tasks for the blockchain. It is an active way of securing the blockchain through the proof-of-stake consensus protocol.

According to the Proof-of-Stake mechanism, the more cryptocurrency on stake one has, the higher is the chance that the validator node will have the opportunity to validate a blockchain transaction. Consequently, the validator has a higher chance of being rewarded for performing that task.

Unlike the Proof-of-Work mechanism, which depends on the computing power of the mining devices, the Proof-of-Stake mechanism prefers those who have larger amounts at stake.

As the second most valuable cryptocurrency, Ethereum has gained a lot of trust from its community, and its value has been going up drastically over the years.

Ethereum 2.0 is the upcoming set of upgrades of the Ethereum network. The Ethereum 2.0 network will be faster, less expensive, and more scalable. It will also consume less energy.

Ethereum 2.0 staking offers decent returns. The current staking reward market rate is 7.8%, which is a pretty decent return for assets held passively.

With the accessibility of crypto exchanges, staking pools, and different hardware for staking at home, more and more Ethereum investors start to stake their coins and earn incentives.

According to an article published by Bitcoin Suisse , Ethereum 2.0 is likely to become the largest staking market, with the likelihood of development of ETH2 futures and higher borrowing and lending rates in DeFi.

Why should you stake Ethereum?

The incentive for staking can come in two folds. Firstly, you earn more coins in the form of staking rewards, and secondly, your coins appreciate against fiat currency.

One downside of staking is that once you deposit your coins into a staking contract, they are locked for a fixed period of time. Therefore you are unable to sell them before the fixed period of time has passed.

However, staking is an excellent investment method for long-term investors who want to hold their Ether long term and let it grow over time.

how to stake your Ether?

There are multiple ways to stake your Ether. You can stake your cryptocurrency on exchanges, in staking pools, or at home. Each way differs by various aspects, such as complexity, security, and entry barriers.

Crypto Exchanges and Staking Pools

The need for staking pools and staking services on crypto exchanges arises from the requirement to have 32 ETH (more than $125’000 based on the current market price 10.05.2021) to run a validator node.

Understandably, this is a significant obstacle for those who have only a few ETH in their wallets. Therefore, the staking pools were created to enable people to pool their holdings and earn proportionate staking rewards.

Staking pools seem like a quick and easy solution for those who don’t hold 32 ETH. However, this solution has certain risks that should be considered before deciding to participate in it.

The main problem with staking pools is the same problem that other centralized systems face. By taking part in a staking pool, you rely on it not to act maliciously, get penalized, and cause the loss of your cryptocurrency. Also, you rely on the pool to keep your coins in their custody. If the staking pool gets compromised in any way, you run the risk of losing your entire investment.

DIY Staking at Home

Staking at home may not be the first solution most ETH investors would think about.

Even though staking at home is the most lucrative way to stake your cryptocurrency, most crypto enthusiasts shy away from it. They think that setting up their own validator node is very complicated and time-consuming.

And indeed, that is the case if you start building your blockchain computer from scratch. You need to put together different hardware pieces to create a computer that will run an Ethereum validator node. Next, you need to install the appropriate software, take care of the uptime, regular maintenance, and keep your validator node software up to date.

We realised that this is a high barrier to entry for most ETH investors. Therefore we created AVADO, a pre-configured blockchain computer that enables users to simply plug it in, sync it and start running a validator node. We take care of the maintenance and software updates.

Therefore we make running your own validator node at home as easy as staking in a pool or on an exchange.

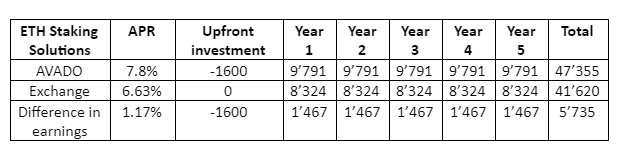

Case study: Staking ETH on an exchange vs. on AVADO (1 and 5-year timeline)

One of the easiest and the most popular staking methods today is staking through crypto exchanges such as Kraken and Coinbase.

The current (10.05.2021) market staking reward for staking ETH is around 7.8%, and both exchanges charge 15% of the earned incentives as administrative fees.

Let’s look at how much we can earn by staking 32 ETH on Coinbase and Kraken versus how much we can make by staking on AVADO over a 1 year time period and over a 5 year time period.

Date: 10.05.2021

ETH staked: 32

ETH price: $ 3’922

ETH APR: 7.8%

Staking period: 1 year; 5 years

Staking on AVADO (1 year time period)

Total holdings: 32 ETH x 1.078 = 34.496 ETH or in other words $ 125’530 x 1.078 = $ 135’321

Rewards earned: 2.496 ETH or $ 9’791

Rewards paid out: 2.496 ETH or $ 9’791

Effective APR: 7.8%

Upfront investment into buying AVADO: $ 1600

Staking on Kraken or Coinbase (1 year time period)

Total holdings: 32 ETH x 1.078 = 34.496 ETH or in other words $ 125’530 x 1.078 = $ 135’321

Rewards earned: 2.496 ETH or $ 9’791.

Fees paid to the exchange: 0.374 ETH or $ 1’467

Rewards paid out: 2.122 ETH or $ 8’324

Effective APR: 6.63%

No upfront investment is required.

Staking on AVADO vs. on an exchange (5 year time period)

Conclusion

Either way, staking in a pool, on an exchange or at home is a good way to earn passive income while supporting your favorite blockchain project.

We recognize that for those who don’t have 32 ETH in their wallets, staking on an exchange or in a pool may be the only option available at the moment.

On the other hand, if you possess enough ETH to set up your own validator node, then staking on AVADO is an absolute no brainer, as you will earn a higher ROI long term.

Nevertheless, every staking method has its own advantages and disadvantages, so we suggest you do your own due diligence and get yourself familiar with the risks and rewards of each solution.

We hope that with this article we have helped you get one step closer in choosing what is the best solution for your specific case.

AVADO is a plug and play blockchain computer. Running a blockchain node on AVADO is the easiest way to participate in decentralized networks that reward you with crypto. ⛓️ ⬛

You get access through its WiFi hotspot or VPN. 🌐 💻

The user-friendly UI allows you to use and manage the device from anywhere in the world. 🌎

It comes pre-installed with the AVADO OS, saving you a lot of time and research setting up a node. ⌛

Using an AVADO is convenient, secure and true to the spirit of decentralization. 🙌🏻

Get your AVADO at www.ava.do/shop or join our Telegram group https://t.me/joinchat/F_LlkBLEoDrFioPNviEpsQ